Market Perspective Newsletter

On an annual basis our Investment Committee meets to develop a firm view of the financial markets, to express that view in our investment strategies, and to articulate it in our annual Market Perspective. We did so again in the first quarter of this year and, with a little delay due to technology and compliance, posted it here.

We would encourage you to read it for several reasons. Based on a variety of research, we feel it provides some insight into the dynamics driving the markets – surrounding both valuation and speculation. As usual, it relies heavily on charts, which makes it a fairly quick read and reasonably digestible. Unlike in previous years, we have used it to describe the methodology we use for constructing our various portfolio models. As an investor, you may be interested to understand how we incorporate our views of the financial markets in your portfolio.

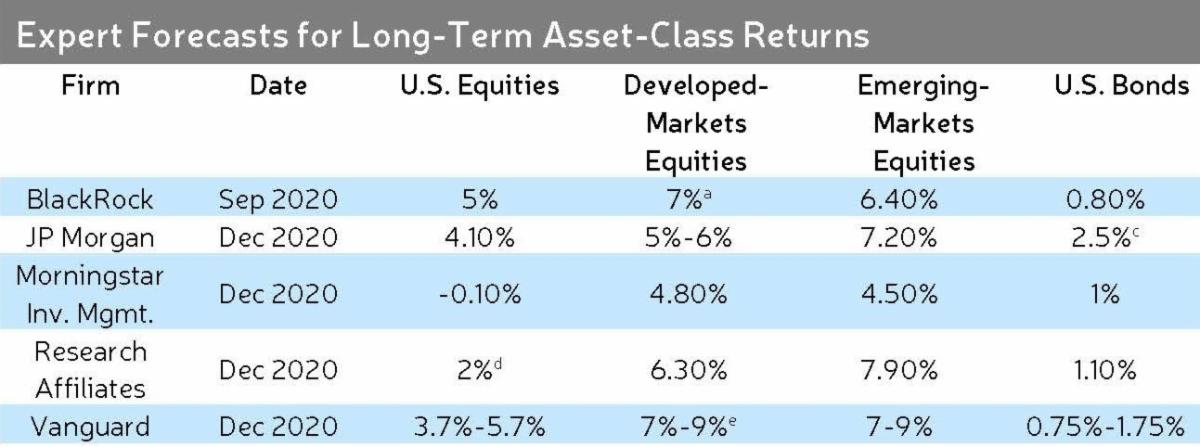

We are acutely aware that our view that the US stock market is not new, and we are starting to sound naïve or overly enamored of our historic thinking. Perhaps we have been wrong – and continue to be. With that said, however, as we show in the Market Commentary, that view is now more widely accepted.

a. European equities

b. 10-15 year horizon

c. Investment-grade corporate

d. U.S. large caps

e. Estimate is for all non-U.S. equities

https://www.morningstar.com/articles/1018261/experts-forecast-stock-and-bond-returns-2021-edition

As we have said before, the financial markets are largely unpredictable over the short term. We don’t purport to know where they are heading tomorrow. Instead, we do our best to develop a well-reasoned, long-range outlook, and to design portfolios that are balanced over various market conditions. That means potentially minimizing the level of risk you assume in order to pursue the returns you need, aiming for greater consistency over time. We harness the best academic thinking in finance science to create portfolios that are durable and resilient.

As always, we welcome your comments and feedback.

Please see our 2021 Market Perspective to view the newsletter.